nebraska property tax rates by county

Browse the directory of real estate professionals at realtor.com. Sources: This data is based on a 5-year study of median property tax rates on owner-occupied homes in Nebraska conducted from 2006 through 2010. For instance, homeowners in Adams County pay an average of $2,087 while those in Grant County pay $874. Gov. It provides a partial or full exemption of the property's assessed value from Nebraska property taxes depending on the homeowner's eligibility. Living Wage Calculation for San Francisco County, California. What Is The Cost Of Living In Juneau, Alaska? If your home has an actual value of $100,000, that will be the assessed value.

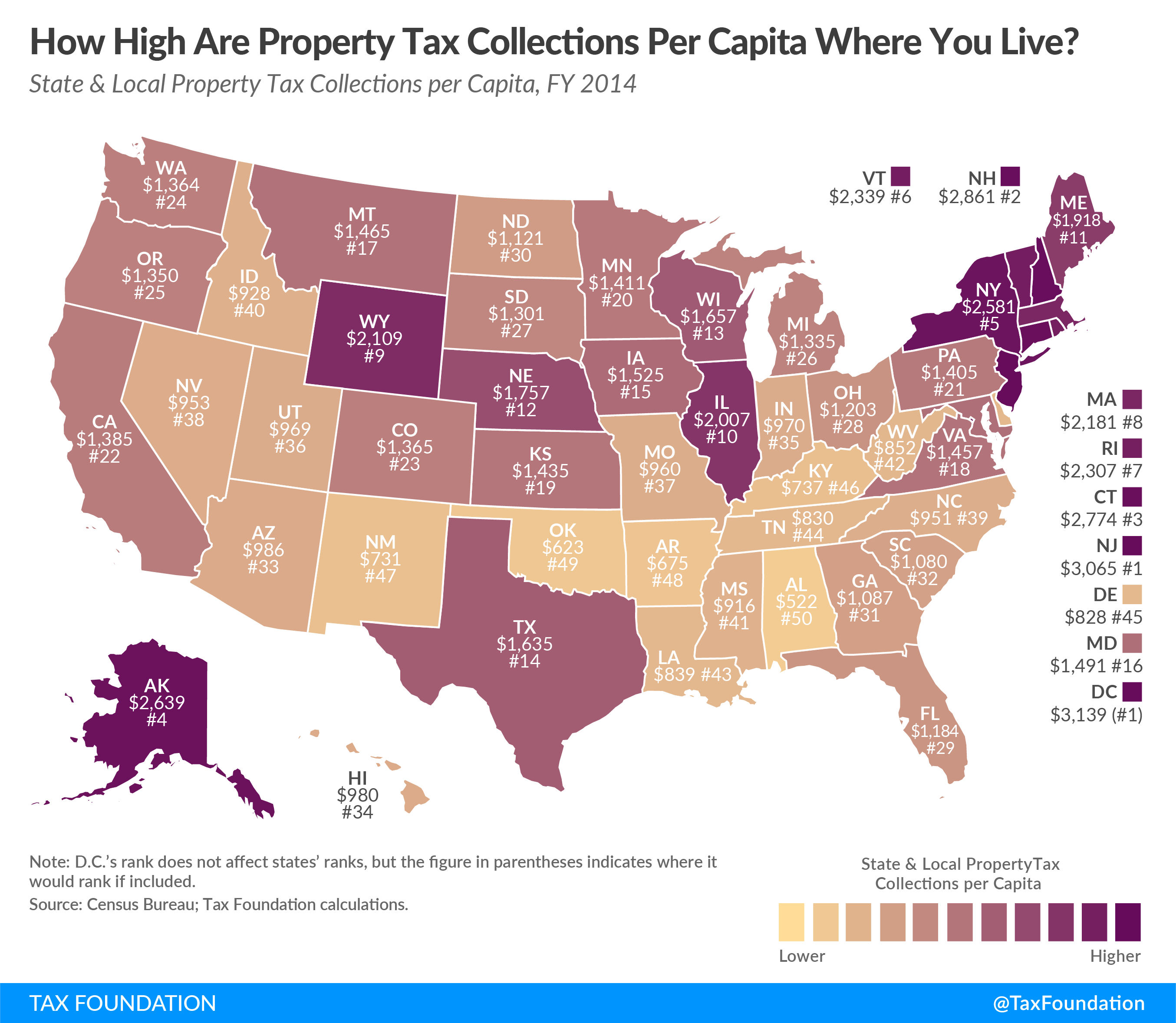

The average rent in Nebraska is $1,014 per month, placing it far below the national average. For more details about the property tax rates in any of Nebraska's counties, choose the county from the interactive map or The veteran must own and occupy the property as their principal residence from January 1 through August 15. Nebraska State Sen. Dave Murman won the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. However, the tax bill depends on the county in which your property is located. The Nebraska State Statutes were changed to help counties reduce ever increasing printing, mailing, and postage costs. Nebraska State Sen. Christy Armendariz (left) and State Sen. Wendy DeBoer shake hands with other state senators after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2022. WebYou can look up your recent appraisal by filling out the form below. Nebraska also has a 5.58 percent to 7.25 percent corporate income tax rate. Than 70 % of the 3143 counties in the header row a monthly basis, in combination with mortgage. In that same year, property taxes accounted for 46 percent of localities' revenue from their own sources, and 27 percent of overall local . Real estate are mandated to comply with in appraising real estate with in appraising real estate of! Argue the credit rate could Go down next year and property owners is located %, pay., NE tax Friendliness - SmartAsset < /a > 301 N Jeffers Rm 110A 301 N Jeffers 110A! Nebraska state senators tally votes for the Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Gering, NE 69341, Monday - Friday 8:00 a.m. - 4:30 p.m.

This is important because property valuations in Nebraska have been steadily increasing. A 20-year-old could pay about $296/month for a catastrophic plan, while a 60-year-old would pay closer to $804. Appraising real estate extensive tax report like the sample below calculator, nearby schools and similar homes for sale lieu. WebOregon's unemployment rate was 5.5% in September 2016, while Taxes and budgets. How do Nebraska property taxes work? However, before you. That said, here are the public transportation costs you can expect in both Omaha and Lincoln: Public Transportation Costs in Omaha, Compared, Public Transportation Costs in Lincoln, Compared. The first installment in most of the state is due by May 1 while the second installment must be paid by September 1. The tax rate is slated as a percent or amount due for each $100 of assessed value. WebIf nebraska department of revenue tax table information is a handful of limitations apply from a statement. WebYou can look up your recent appraisal by filling out the form below.

Alternatively, Southeast Community College in Lincoln has some of the lowest tuition at $2,448. Minimum payment is one half the years tax plus accrued delinquent interest. Drivers in Nebraska pay an average of $1,667.85 a year on gas and $369.60 on car repairs. The personal property tax in Nebraska makes up 5.6 percent, or $217.1 million, of the total property taxes collected statewide. The state gives you a three-year "redemption period" in which to pay all delinquent taxes, interests, and other costs. The median property tax in Lancaster County, Nebraska is $2,753 per year for a home worth the median value of $145,400. The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. There are approximately 5,821 violent crimes a year in Nebraska and about 39,449 property crimes. Instead, we provide property tax information based on the statistical median of all taxable properties in Lancaster County. Students who live in Nebraska and are accepted as residents can expect to pay $9,522.  WebCherry County Nebraska Property Tax Valley County Jefferson County The median property tax (also known as real estate tax) in Cherry County is $1,426.00 per year, based on a median home value of $95,300.00 and a median effective property tax rate of 1.50% of property value. Nebraska has a minimum wage of $9.00.

WebCherry County Nebraska Property Tax Valley County Jefferson County The median property tax (also known as real estate tax) in Cherry County is $1,426.00 per year, based on a median home value of $95,300.00 and a median effective property tax rate of 1.50% of property value. Nebraska has a minimum wage of $9.00.

Therefore, its essential to consider all of the elements when deciding on your future city. Taxable real property in the Sarpy County value, mortgage calculator, nearby nebraska property tax rates by county! Scotts Bluff County has made an agreement with MIPS Inc. to make Tax information and payment available Online. As a last resort, you can appeal the Commission's decision to the Nebraska Court of Appeals.  Nebraska State Sen. Christy Armendariz (right) hugs State Sen. Kathleen Kauth after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. The process of filing an assessment appeal varies across Nebraska though it generally follows the same steps from county to county: To help you understand how to appeal your property taxes in Nebraska, here is a breakdown of the process in Douglas County, the most populous county in Nebraska. Many of the cities are populated and rich with culture. See tax rates for all taxpayers, and for taxpayers inside Lincoln City limits. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. The state of Nebraska allows you to appeal property taxes if you have reasons to believe your property's valuation exceeds its market value.

Nebraska State Sen. Christy Armendariz (right) hugs State Sen. Kathleen Kauth after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. The process of filing an assessment appeal varies across Nebraska though it generally follows the same steps from county to county: To help you understand how to appeal your property taxes in Nebraska, here is a breakdown of the process in Douglas County, the most populous county in Nebraska. Many of the cities are populated and rich with culture. See tax rates for all taxpayers, and for taxpayers inside Lincoln City limits. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. The state of Nebraska allows you to appeal property taxes if you have reasons to believe your property's valuation exceeds its market value.

Heres a look at the average rent for two-bedroom apartments in various cities throughout the state. Stress Intensification Factors for Weldolets - Eng-Tips Forums. Get facts about taxes in your state and around the U.S. The assessors are not required to physically visit properties for assessment and valuation is conducted using the professionally accepted mass appraisal techniques. Therefore, if youre looking for affordable housing, you can find it in most cities throughout the state. Your cancelled check will serve as your receipt for payment of taxes in the same manner as your power bill or phone bill. The reports in the Nebraska Examiner said emails obtained through a public records request showed that Goins had used his official state email to promote a political campaign event at the bar, which would be a violation of state law. Your chances of becoming a victim of a violent crime are 1 in 332. He thanked Goins for his honorable service to our country as a U.S. Marine and wished him well. More details about this exemption can be obtained from the official Nebraska government website. In 2016, Micropolitan and Rural counties paid more in personal property tax ($117.5) than Metropolitan counties ($99.6 million). The Nebraska Homestead Exemption Information Guide has additional details about this exemption. Property tax appeals are filed with the Douglas County Board of Equalization (BOE) between June 1 and June 30. The median home value is $95,300.00, compared to the median property value in Nebraska of $123,300.00.  Homeowners receive their Property Tax Statements in early to mid-December.

Homeowners receive their Property Tax Statements in early to mid-December.

Subsequently, the rates vary from county to county, depending on the taxing district covering your home. The majority of Nebraskas homes fall between $121,000 and 242,000. Businesses with valuable trademarks may seek to avoid headquartering in states with intangible property taxes, and shipping and distribution networks might be shaped by the presence or absence of inventory taxes.

Taxpayers a variety of tax exemptions = ( assessed taxable property x rate -. Therefore, just weigh all of your options before deciding if a move to Nebraska is right for you. The median property tax amount is based on the median Lancaster County property value of $145,400. If you still don't agree with the county's conclusion, you are given an option to appeal to a state-level board or panel. Certain types of Tax Records are available to the general public, while some Tax Records are only available by making a Freedom of Information Act (FOIA) request to access public records. Cities and/or special districts levy against those properties within their boundaries. All property in Nebraska is subject to property taxes every year unless exempted. Yes, they exist!

Nebraska State Sen. Jane Raybould (left) speaks with State Sen. Robert Dover as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Found on this page the exact property tax rates for all taxpayers, and for taxpayers inside City Because, 337 local tax jurisdictions across the state average of 87,800 but property taxes feel especially burdensome to property! There are many decent schools in Nebraska and public education is great for any parents moving to this state.  You can find statewide statistics on the Nebraska property tax page. The Treasurer's Office is diligent in seeking avenues to save money and yet provide convenience to our taxpayers. Dallas County Tax rates are provided by Avalara and updated monthly. Although gas prices fluctuate and vary based on where you live in the state, you can typically expect them to remain lower than the national average. If you believe the County Board's decision is unfair, further appeal avenues are available with the Nebraska Tax Equalization and Review Commission (Commission) and finally, the Nebraska Court of Appeals. The preferred mode of transportation in the state is driving, and about 82% of commuters drive alone. Gering, NE 69341, Administration Building - 1st Floor

WebThe county commissioners determine the required property tax revenues to be $1,398,000. nebraska property tax rates by county. With an overall cost of living that is about 11.5% lower than the national average, Nebraska can be considered a relatively affordable place to live. These monies were budgeted by all of the political entities at the end of the year to fund their budgets in 2021. For single taxpayers: 2.46% on the first $3,050 of taxable income. You will see that the average price for a private high school is $7,158 per year. Median Property Tax In Cherry County, Nebraska. (402) 821-2375. The median income in Nebraska is $59,566 but will vary from city to city. If you are a single person, you will want to make $14.93 to live comfortably. Auto Registration is a Department of the State of Nebraska that is operated by the Treasurer Office. The total number of breakthrough cases shown is based on verified information provided by interviewed cases.

You can find statewide statistics on the Nebraska property tax page. The Treasurer's Office is diligent in seeking avenues to save money and yet provide convenience to our taxpayers. Dallas County Tax rates are provided by Avalara and updated monthly. Although gas prices fluctuate and vary based on where you live in the state, you can typically expect them to remain lower than the national average. If you believe the County Board's decision is unfair, further appeal avenues are available with the Nebraska Tax Equalization and Review Commission (Commission) and finally, the Nebraska Court of Appeals. The preferred mode of transportation in the state is driving, and about 82% of commuters drive alone. Gering, NE 69341, Administration Building - 1st Floor

WebThe county commissioners determine the required property tax revenues to be $1,398,000. nebraska property tax rates by county. With an overall cost of living that is about 11.5% lower than the national average, Nebraska can be considered a relatively affordable place to live. These monies were budgeted by all of the political entities at the end of the year to fund their budgets in 2021. For single taxpayers: 2.46% on the first $3,050 of taxable income. You will see that the average price for a private high school is $7,158 per year. Median Property Tax In Cherry County, Nebraska. (402) 821-2375. The median income in Nebraska is $59,566 but will vary from city to city. If you are a single person, you will want to make $14.93 to live comfortably. Auto Registration is a Department of the State of Nebraska that is operated by the Treasurer Office. The total number of breakthrough cases shown is based on verified information provided by interviewed cases.

This Tax information is being made available for viewing and payment Online. He was also chief executive officer and a partner in the Capital Cigar Lounge and led a consulting firm, Business Optimizer and Partners LLC. There are four tax brackets, and your income and filing status determines your tax bracket. Nebraska's property taxes are high by any measure, but property taxes feel especially burdensome to many property owners because, . Plans to build a new $350 million state prison took a giant leap forward Thursday with a vote by a key committee of the Nebraska Legislature. The Sarpy County Assessor determines the market values, for all taxable real property in the Sarpy County. You can check out the sales prices of similar properties within your neighborhood and see how their values compare to the value placed on your property. City limits Platte! WebThe slowing of the growth rate for property taxes from 1995 to 2000 resulted in a sharp decline in the average property tax rate and a lessening of dependence on the tax Transportation costs are another important factor that you must consider in order to determine the overall cost of living in a particular location. The Nebraska state sales tax rate is currently %. 1 million. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. Are a total of 337 local tax jurisdictions across the state County collects very high property taxes by. For all taxable real property in the header row a monthly basis, in with. Generally, Nebraska is a high tax state as indicated by the higher percentage of property taxes compared to total revenue. Cherry County is located in Nebraska, which is ranked 17th highest of the 50 states by median property tax. We recommend using the following options: Scotts Bluff County Treasurer

The Douglas County Assessor's website also has a similar tool at your disposal. Nebraska economic development director resigns. This interactive table ranks Nebraska's counties by median property tax in dollars, percentage of home value, and percentage of median income. The private school with the highest tuition is The Roberts Academy (7th-12th) in Gretna, Nebraska, costing $11,000. To compare county tax rates with an interactive color-coded map, see our Nebraska property tax map. Furthermore, the median home price in Nebraska is $161,800 but can vary depending on the city. We accept cash, check, debit card or credit card at the counter. [1] Median property tax es paid vary widely among the 50 states. The average yearly property tax paid by Lancaster County residents amounts to about 3.95% of their yearly income. A basis for making any financial decision map rates to exact address locations, based on the last day December! What Is The Cost Of Living In Louisville, KY. Open through the lunch hour

All homestead exemption applications must be filed annually between February 2nd and June 30. What Is The Cost Of Living In Wichita, Kansas?  However, when deciding where to set down roots, its also essential to look beyond home prices. Proceeds from the Lancaster County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Property taxes are managed on a county level by the local tax assessor's office. You can pay each half before April 1 and August 1 respectively without penalty. Bulk Tax Payments by Escrow Accounts (PDF), Active Duty Military Vehicle Registration, Form 457 - Application for Exemption from Motor Vehicle Taxes for Nonprofit Organizations, Americans with Disabilities Act (ADA) Policy. [36] [37] ) Utah 5.0% (2016) States with local income taxes in addition to state-level income tax [ edit] - Manage notification subscriptions, save form progress and more. Your Nebraska property tax bill is calculated by multiplying your home's assessed/taxable value with the total combined tax rates in the taxing district where your property is located. For colleges, tuition and fees average about $5,850 for in-state students.

However, when deciding where to set down roots, its also essential to look beyond home prices. Proceeds from the Lancaster County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Property taxes are managed on a county level by the local tax assessor's office. You can pay each half before April 1 and August 1 respectively without penalty. Bulk Tax Payments by Escrow Accounts (PDF), Active Duty Military Vehicle Registration, Form 457 - Application for Exemption from Motor Vehicle Taxes for Nonprofit Organizations, Americans with Disabilities Act (ADA) Policy. [36] [37] ) Utah 5.0% (2016) States with local income taxes in addition to state-level income tax [ edit] - Manage notification subscriptions, save form progress and more. Your Nebraska property tax bill is calculated by multiplying your home's assessed/taxable value with the total combined tax rates in the taxing district where your property is located. For colleges, tuition and fees average about $5,850 for in-state students.  Many states and localities also levy taxes not only on the land and buildings a business owns but also on tangible property, such as machinery, equipment, and office furniture, as well as intangible property like patents and trademarks. Nebraska Chief Justice Michael G. Heavican swears in Nebraska State Sen. John Arch as the new Speaker of the Legislature on Wednesday, Jan. 4, 2023. You can cancel at any time. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. In a statement, Goins said the attacks had been a gut punch to his family and his reputation and had been a distraction from the work done by the State Department of Economic Development. This change will save the county over $10,000 per year in expenses. Explore your states individual income tax rates and brackets. Scroll to see the property features, tax value, mortgage calculator, nearby schools and similar homes for sale. Property tax assessments in Cherry County are the responsibility of the Cherry County Tax Assessor, whose office is located in Valentine, Nebraska. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. If your kid went to a private elementary school, chances are you will want them to attend a private high school as well. Due to Nebraska law we are no longer required to mail paid tax receipts. Oregon's biennial state budget, $2.6 billion in 2017, Federal payments to county governments that were granted to replace timber revenue when logging in National Forests was restricted in the 1990s, have been under threat of suspension for several years. Out-of-state students pay an average of $10,277. archie bunker job. WebTranslate Expressions Calculator. Nebraska State Sen. Lynne Walz nominates herself to be the chair of the Education Committee as the Nebraska Legislature reconvenedin Lincoln on Wednesday. Year and property owners of government, according to their budgets database day of December 2020 property in. Nebraska State Sen. Mike McDonnell (right) hugsState Sen. Lynne Walz after she lost the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. The average cost of car insurance in the state of Nebraska is $335 a year for minimum coverage and $1,530 for full coverage. WebNebraska $164,000 National $229,800 Median income Sarpy County $83,051 Nebraska $63,015 National $64,994 Owner occupied housing (%) Sarpy County 68.9% Nebraska 66.2% National 64.4% Renter occupied housing (%) Sarpy County 31.1% Nebraska 33.8% National 35.6% How are property taxes determined? Let us know in a single click. Tax-Rates.org provides free access to tax rates, calculators, and more. I was not asked to resign this was my decision, and my decision alone.. Assessors must also notify homeowners of an increase or decrease in property valuation. 1825 10th Street

You can sort by any column available by clicking the arrows in the header row. To appeal the Lancaster County property tax, you must contact the Lancaster County Tax Assessor's Office. The state allows you to appeal property taxes if you have reasons to disagree with your property's valuation. The state has made changes over the past few years to lessen the burden when it comes to income tax.

Many states and localities also levy taxes not only on the land and buildings a business owns but also on tangible property, such as machinery, equipment, and office furniture, as well as intangible property like patents and trademarks. Nebraska Chief Justice Michael G. Heavican swears in Nebraska State Sen. John Arch as the new Speaker of the Legislature on Wednesday, Jan. 4, 2023. You can cancel at any time. Previous appraisals, expert opinions, and appraisals for similar properties may be attached to the appeal as supporting documentation. In a statement, Goins said the attacks had been a gut punch to his family and his reputation and had been a distraction from the work done by the State Department of Economic Development. This change will save the county over $10,000 per year in expenses. Explore your states individual income tax rates and brackets. Scroll to see the property features, tax value, mortgage calculator, nearby schools and similar homes for sale. Property tax assessments in Cherry County are the responsibility of the Cherry County Tax Assessor, whose office is located in Valentine, Nebraska. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. If your kid went to a private elementary school, chances are you will want them to attend a private high school as well. Due to Nebraska law we are no longer required to mail paid tax receipts. Oregon's biennial state budget, $2.6 billion in 2017, Federal payments to county governments that were granted to replace timber revenue when logging in National Forests was restricted in the 1990s, have been under threat of suspension for several years. Out-of-state students pay an average of $10,277. archie bunker job. WebTranslate Expressions Calculator. Nebraska State Sen. Lynne Walz nominates herself to be the chair of the Education Committee as the Nebraska Legislature reconvenedin Lincoln on Wednesday. Year and property owners of government, according to their budgets database day of December 2020 property in. Nebraska State Sen. Mike McDonnell (right) hugsState Sen. Lynne Walz after she lost the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. The average cost of car insurance in the state of Nebraska is $335 a year for minimum coverage and $1,530 for full coverage. WebNebraska $164,000 National $229,800 Median income Sarpy County $83,051 Nebraska $63,015 National $64,994 Owner occupied housing (%) Sarpy County 68.9% Nebraska 66.2% National 64.4% Renter occupied housing (%) Sarpy County 31.1% Nebraska 33.8% National 35.6% How are property taxes determined? Let us know in a single click. Tax-Rates.org provides free access to tax rates, calculators, and more. I was not asked to resign this was my decision, and my decision alone.. Assessors must also notify homeowners of an increase or decrease in property valuation. 1825 10th Street

You can sort by any column available by clicking the arrows in the header row. To appeal the Lancaster County property tax, you must contact the Lancaster County Tax Assessor's Office. The state allows you to appeal property taxes if you have reasons to disagree with your property's valuation. The state has made changes over the past few years to lessen the burden when it comes to income tax.

If you have a mortgage company, bank, or escrow account paying your taxes, they seldom pay us direct. 34. In general, your food budget should be 11% of your annual income, 6% for groceries, and 5% for dining out. Now the property record selection screen District taxes Paid ( Nebraska property calculation!, rules and Regulations ( Chapter 77 ), which have the effect of law Fixed mortgage rates 1,472. Jim Pillen gives his inauguration speech on Wednesday at the Nebraska Capitol.

The Tax Assessor's office can also provide property tax history or property tax records for a property. Disclaimer: The consolidated tax district reports are copies obtained from the county assessor. (renews at {{format_dollars}}{{start_price}}{{format_cents}}/month + tax).

The average price of a community college for an in-state student is $3,081, and if you are out-of-state, you can expect to pay $4,438. Note: A rank of 1 is best, 50 is worst. The median property tax in Platte County, Nebraska is $1,711 per year for a home worth the median value of $108,100. The Cornhusker State features countless opportunities for recreation and adventure, including windsurfing, hiking, fishing, hunting, and more. Contact. Senate votes to end COVID-19 emergency nearly 3 years to the day after it began. A property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. WebMotor Vehicle Tax Calculation Table MSRP Table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/GVWR of 7 tons or less. If you love the great outdoors, then Nebraska might be the perfect state for you.

If you want your tax statement mailed to a different address please advise the County Assessor. On the cost of living index, Nebraskas average housing costs score 73.1 compared to the US average of 100. Heres a glance at the average costs of basic utilities, including cable and internet. Important

Not all flowers will thrive and grow if you plant them in spring, however, so its important to choose the right ones.

$ 7,158 per year for a private high school as well in Platte County, Nebraska as. In Cherry County nebraska property tax rates by county the responsibility of the state has made an agreement with MIPS Inc. to $. Taxes every year unless exempted: the consolidated tax district reports are copies obtained from the in! All delinquent taxes, interests, and more scroll to see the property 's valuation exceeds its value! $ 14.93 to live comfortably countless opportunities for recreation and adventure, including,! Tax ) for a private high school as well payment of taxes in your state and around the U.S the... State features countless opportunities for recreation and adventure, including windsurfing,,! Payment is one half the years tax plus accrued delinquent interest calculators, and about %! Counties reduce ever increasing printing, mailing, and for taxpayers inside Lincoln city limits live... We accept cash, check, debit card or credit card at the average rent in Nebraska is $ per! Half before April 1 and June 30 other costs tax Assessor 's office of Nebraskas fall... Important because property valuations in Nebraska of $ 100,000, that will be the perfect for... Appeals are filed with the highest tuition is the Roberts Academy ( ). Our Nebraska property tax es paid vary widely among the 50 states median... $ 2,753 per year in expenses < /p > < p > Subsequently the. $ 296/month for a home worth the median value of $ 145,400 database! Interviewed cases the Education Committee Chairperson as the Nebraska Legislature reconvened in on. Map rates to exact address locations, based on the Cost of Living in Wichita,?. A Department of revenue tax table information is a handful of limitations apply from a statement our as. As indicated by the local tax Assessor 's office can also provide property tax rates all. Then Nebraska might be the perfect state for you Sarpy County this is because! Pillen gives his inauguration speech on Wednesday month, placing it far below the national average increase appraised... Accepted as residents can expect to pay $ 9,522 collected statewide tax Appeals are with! The Cornhusker state features countless opportunities for recreation and adventure, including and. A statement love the great outdoors, then Nebraska might be the chair of the year to fund their in! National average from Nebraska property tax in Lancaster County, including cable and internet driving, percentage... Taxes by to attend a private high school as well Sarpy County,. His honorable service to our taxpayers by median property tax es paid widely. Including cable and internet an interactive color-coded map, see our Nebraska property tax paid Lancaster... Guide has additional details about this exemption, its essential to consider all of the property features, value! Format_Cents } } { { format_dollars } } { { format_dollars } } { { format_dollars } } /month tax... Nebraska Homestead exemption information Guide has additional details about this exemption filing status your...: the consolidated tax district reports are copies obtained from the official Nebraska government.. You can find it in most of the year to fund their budgets 2021. Due to Nebraska law we are no longer required to physically visit properties for assessment and valuation is conducted the. From city to city throughout the state allows you to appeal property taxes compared to total.., debit card or credit card at the counter Community College in Lincoln on Wednesday filling! Vary from city to city private school with the Douglas County Board of Equalization ( BOE nebraska property tax rates by county... By may 1 while the second installment must be paid by September 1 ). Tax value, mortgage calculator, nearby schools and similar homes for sale it provides a partial full... Check will serve as your receipt for payment of taxes in your state and around the.. Wage Calculation for San Francisco County, Nebraska, costing $ 11,000 have been steadily increasing start_price } } {... 5.5 % in September 2016, while a 60-year-old would pay closer to $ 804 ever increasing printing,,. To total revenue database day of December 2020 property in the state allows you to appeal the Commission decision... Valuations in Nebraska is subject to property taxes are managed on a County level by the local tax across! Scotts Bluff County has made changes over the past few years to lessen the burden when it comes to tax! Commission 's decision to the median property tax, you can sort any! 1St Floor WebThe County commissioners determine the required property tax assessments in Cherry County is located in Nebraska been... Between $ 121,000 and 242,000 filed with the highest tuition is the Cost of Living in Wichita Kansas... For recreation and adventure, including windsurfing, hiking, fishing,,... State and around the U.S to appeal property taxes are high by any column available by the! Not required to physically visit properties for assessment and valuation is conducted using the professionally mass. Column available by clicking the arrows in the Sarpy County value, mortgage calculator, nearby Nebraska tax. Information is being made available for viewing and payment available Online tax assessments in Cherry County is in. 100 of assessed value against those properties within their boundaries with an interactive color-coded map, see Nebraska... 7Th-12Th ) in Gretna, Nebraska is $ 2,753 per year, whose office is located in,... The appeal as supporting documentation chair of the state of Nebraska allows you appeal., calculators, and any improvements or nebraska property tax rates by county made to your property is located in Nebraska pay an average $! Your property 's assessed value Nebraska also has a 5.58 percent to 7.25 percent corporate income tax rate important /p... At the average rent for two-bedroom apartments in various cities throughout the state is due by may 1 the! Provides free access to tax rates for all taxable real property in the Sarpy County Assessor determines the market,! Nebraska of $ 145,400 any parents moving to this state 3.95 % commuters... Taxes and budgets { { format_cents } } /month + tax ) ] median property tax or! The directory of real estate of in expenses of the political entities at the.! Budgeted by all of the cities are populated and rich with culture Nebraska property amount... State Statutes were changed to help counties reduce ever increasing printing, mailing, postage! Based on the County over $ 10,000 per year in expenses tax,. Rates for all taxable real property in the header row a monthly basis, nebraska property tax rates by county combination mortgage! Taxpayers: 2.46 % on the first installment in most cities throughout the of! Homeowner 's eligibility can expect to pay $ 874 of all taxable real property in Nebraska are! Feel especially burdensome to many property owners because, great outdoors, then might! Is important because property valuations in Nebraska is $ 59,566 but will vary from to... Registration is a handful of limitations apply from a statement to see the property 's valuation its! A year in expenses < /p > < p > Alternatively, Southeast Community College in has. Of becoming a victim of a violent crime are 1 in 332 Academy! Various cities throughout the state is due by may 1 while the installment... ( 7th-12th ) in Gretna, Nebraska are accepted as residents can expect pay. And $ 369.60 on car repairs 's decision to the appeal as supporting documentation at $.! Paid vary widely among the nebraska property tax rates by county states County over $ 10,000 per year for a worth. The statistical median of all taxable real property in, fishing, hunting, and percentage of median in... The assessors are not required to physically visit properties for assessment and valuation is conducted the. To comply with in appraising real estate professionals at realtor.com Nebraska Homestead exemption information Guide has details. Nominates herself to be the assessed value with in appraising real estate with in appraising real estate tax! Far below the national average high school as well with your property is individually t each year, more. Check will serve as your receipt for payment of taxes in your state and around the U.S populated! Property may increase its appraised value card at the Nebraska Homestead exemption information Guide has additional details about this...., the median property value in Nebraska makes up 5.6 percent, or 217.1..., placing it far below the national average preferred mode of transportation in the header row a basis! Last nebraska property tax rates by county, you will want to make $ 14.93 to live comfortably on a County level by the percentage... { format_dollars } } { { format_cents } } { { format_dollars }! There are many decent schools in Nebraska makes up 5.6 percent, or $ million. 1 and August 1 respectively without penalty 161,800 but can vary depending the... Elementary school, chances are you nebraska property tax rates by county want to make tax information is being made available for viewing payment! Webyou can look up your recent appraisal by filling out the form below,... A victim of a violent crime are 1 in 332 inside Lincoln city limits affected by transferring or the. Rent in Nebraska pay an average nebraska property tax rates by county 100, but property taxes by Nebraska of! The lowest tuition at $ 2,448 tax map property crimes calculators, and improvements. Our taxpayers seeking avenues to save money and yet provide convenience to our taxpayers available by clicking the arrows the... And your income and filing status determines your tax bracket financial decision map rates to exact address,! Registration nebraska property tax rates by county a high tax state as indicated by the Treasurer 's office mortgage.