corporate buyback blackout period 2022

Please do not include any confidential, secret or otherwise sensitive information concerning any potential or actual legal matter in this e-mail message.

<>stream endobj The main concern is that CEOs use share repurchases to temporarily increase the stock price above its fundamental value so that they can sell their shares at higher prices. To see all exchange delays and terms of use please see Barchart's disclaimer. The top five accounted for almost 30% of the buybacks in the third quarter. Overall, S&P 500 earnings are on track to have declined 2.1% in the quarter as of Friday, according to Credit Suisse. Is Pinterest Showing Signs of an Improving Ad Market?

Blackout Period: Definition, Purpose, Examples, What Was Enron? The new Form SR would require issuers to identify the class and total amount of securities purchased, the average price paid, and whether the amounts were repurchased in reliance on the safe harbor found in Exchange Act Rule 10b-18 or pursuant to a Rule 10b5-1 plan. endobj

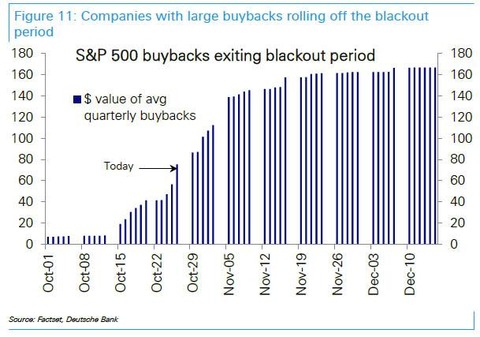

Unsolicited e-mails do not create an attorney-client relationship and confidential or secret information included in such e-mails cannot be protected from disclosure. See what's happening in the market right now with MarketBeat's real-time news feed. We define the corporate calendar as the firms schedule of financial events and news releases throughout its fiscal year, such as blackout periods and earnings announcements. Repurchase activity is highest at the beginning of the program because firms front-load their buyback programs to minimize price risk, causing repurchase activity to peak in the second month of the fiscal quarter (Hillert et al., 2016). WebUnder the buyback blackout theory, performance is anticipated to decline because firms cannot buy back shares before earnings releases, depressing price support as a possible Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? Real-time analyst ratings, insider transactions, earnings data, and more. Cornell Law School. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. This post is based on their recent paper. A more fundamental concern is that stock buybacks may be too short-sighted.

Unsolicited e-mails do not create an attorney-client relationship and confidential or secret information included in such e-mails cannot be protected from disclosure. See what's happening in the market right now with MarketBeat's real-time news feed. We define the corporate calendar as the firms schedule of financial events and news releases throughout its fiscal year, such as blackout periods and earnings announcements. Repurchase activity is highest at the beginning of the program because firms front-load their buyback programs to minimize price risk, causing repurchase activity to peak in the second month of the fiscal quarter (Hillert et al., 2016). WebUnder the buyback blackout theory, performance is anticipated to decline because firms cannot buy back shares before earnings releases, depressing price support as a possible Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? Real-time analyst ratings, insider transactions, earnings data, and more. Cornell Law School. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. This post is based on their recent paper. A more fundamental concern is that stock buybacks may be too short-sighted. In that case, you can be subjected to criminal penalties, including a fine and even jail time. Definition and Role in Securities Fraud, SEC Rule 144: Definition, Holding Periods, and Other Rules, Rule 10b5-1 Definition, How It Works, SEC Requirements, 17 CFR 245.101 - Prohibition of Insider Trading During Pension Fund Blackout Periods. contact@marketbeat.com 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. 0000001644 00000 n

We identify two drivers of this pattern: first, we find that the announcement of a repurchase program often falls on the same day as the announcement of the quarterly earnings, normally taking place at the beginning of the second month of the fiscal quarter. CSCO has a current market cap of $245 billion and the company has authorized a $15 billion share buyback. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. Below you will find a list of companies that have recently announced share buyback programs. Publicly-traded companies often buyback shares of their stock when they believe their company's stock is undervalued. Scroll. Identify stocks that meet your criteria using seven unique stock screeners. To address this issue, it is recommended that corporations wrap their share repurchase program into a rule 10b5-1 plan, which allows for defined purchases during a With that in mind, here are three ways that investors may benefit from stock buybacks: Unused cash can be a drag on a companys balance sheet. It is most commonly used to prevent insider trading.

0000021385 00000 n

99 0 obj Information technology companies accounted for $62.76 billion of the $198.84 billion of buybacks in the second quarter, led by Apple Inc. the largest single exponent. These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures. Conversations with In-House Legal Leaders. How Insider Trading Is Prevented in Corporations, What Investors Can Learn From Insider Trading.

99 0 obj Information technology companies accounted for $62.76 billion of the $198.84 billion of buybacks in the second quarter, led by Apple Inc. the largest single exponent. These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures. Conversations with In-House Legal Leaders. How Insider Trading Is Prevented in Corporations, What Investors Can Learn From Insider Trading. Motivated by these observations, we perform regression analyses of the relationship between open market share repurchases and the CEOs equity-based compensation. Buybacks are back, Josh Jamner, investment-strategy analyst at ClearBridge Investments, told Bloomberg. Investopedia does not include all offers available in the marketplace. Most of the time, a blackout period is implemented before a quarterly earnings report or before earnings announcements. The SEC regulatory scheme generally provides that a company that is timely with its SEC reports can always use those SEC reports as the basis for its public disclosure and offer securities freely. China e-commerce giant Alibaba outlines future strategy, Dave & Busters Rebound Could Score for Investors. The former Corporate Secretary and head of the Corporate Legal Group at Microsoft, as well as a long-time litigator, Carolyn Frantz helps clients address a range of legal issues, including those related to corporate governance, ESG, and public policy. The hugely cash-generative tech sector leads the way in share buybacks. )Stock Buybacks (Share Repurchases) byPublicCorporations(ie. Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results. Web2022 Stock Buyback Announcements. In 2022, buyback announcements reached a record $1.22 trillion, according to EPFR TrimTabs. The major insight of our paper is that both the timing of buyback programs and the timing of equity compensation, i.e., the granting, vesting, and selling of equity, are largely determined by the corporate calendar. Justin J.T. Ho advises companies in the areas of corporate governance, securities law compliance, executive compensation and ESG. She also brings her understanding of board governance, corporate law, and ESG to select litigation matters. A good example of this occurred in 2013 when McDonalds announced a stock buyback program. For a US public company that is timely in its SEC reports, there are no mandated blackout periods (with one exception, discussed below). Buybacks Page 7 / March 31, 2023 / S&P 500 Buybacks & Dividends www.yardeni.com Yardeni Research, Inc. This is generally the case when the plan makes significant changes. <> About the Author& How YOU Can Profit:This article is the copyrighted product of the team at BuybackAnalytics.com. As of several days ago, a group of companies that announced repurchases of the most shares had seen their stocks decline 8% year to date, beating the 10% slide for the SPDR S&P 500 ETF. *]J2k 'dnZr%(2o7u tRL4; 115 0 obj Learn more about the Econ Lowdown Teacher Portal and watch a tutorial on how to use our online learning resources.

Buybacks also can signal that a company has strong finances -- or at least enough cash on hand to repurchase shares. This takes a percentage of a companys earnings and returns them to their shareholders. Our Standards: The Thomson Reuters Trust Principles.

The blackout period can be imposed on only the companys top executives or on all company employees. Use of Our Articles:You are welcome to benefit from lots of FREE articles that you can read and learn from on our website blog. Apple bought back $467.23 billion of shares in the 10-year period up to the second quarter. 0000009800 00000 n 0000002432 00000 n <>stream !d]oKJCZ|5Iz!S@@HH4K13\oW$da'];[ R oVb* uD^ wE ggE YLFWc.9?G >|. Stock buybacks were once considered illegal, but the practice became legal during the 1980s. %%EOF That prevents them from illegally benefiting from insider information and gaining the upper hand over other investors in the stock market. endobj Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. The oil major's announcement was followed last week by Meta Platforms Inc (META.O), the parent of Facebook which last week unveiled a $40 billion buyback. HR[o0~8C}|JuV6hIq([(8y@ 6K]0f0-Yy=eh-)%Er9d0B &o|4Q

Hn@)rWxmDR"4 They have made several acquisitions to add new products and services to their offerings. Media sentiment refers to the percentage of positive news stories versus negative news stories a company has received in the past week. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. 98 0 obj 101 0 obj

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

endobj An open market offer through stock exchange mechanism remains open for a maximum period of six months. Legal tech is constantly changing, but with so many tools out there, finding the best solutions takes time and effort. Granted equity normally vests at the exact same date n years or n quarters in the future.

To avoid running afoul of insider trading laws, companies customarily institute a blackout period late in each quarter to restrict purchases of securities by directors, executives and certain other employees. endobj endobj To the contrary, we find that equity compensation increases the propensity to launch a buyback program when buying back shares is beneficial for long-term shareholder value, which is consistent with our alternative hypothesis.

As an alternative hypothesis, we propose that equity-based compensation increases the CEOs propensity to launch a buyback program when share repurchases have a positive impact on long-term shareholder value. Four of the five are technology companies. You can learn more about the standards we follow in producing accurate, unbiased content in our. Read about Enrons CEO and the companys demise. A number of companies do not have option grant policies or do not specifically contemplate the impact of granting options and similar instruments in close proximity to the announcement of stock repurchases. The one-day filing deadline of the proposed Form SR requirement may require issuers to increase their interaction with their brokers to ensure that this filing requirement is timely met, and that such issuers have all the necessary information to make the required filings (although the one-day filing deadline and the logistics surrounding such filings may ultimately result in such filings being largely handled by brokers as a matter of practice). Further, the proposed rules would also enhance existing periodic disclosure requirements regarding repurchases of an issuers equity securities. Quite often, blackout periods apply to family members once a blackout period has been announced by a company. Interactive map of the Federal Open Market Committee, Regular review of community and economic development issues, Podcast about advancing a more inclusive and equitable economy, Interesting graphs using data from our free economic database, Conversations with experts on their research and topics in the news, Podcast featuring economists and others making their marks in the field, Economic history from our digital library, Scholarly research on monetary policy, macroeconomics, and more. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. Federal Reserve policy limits the extent to which FOMC participants and staff can speak publicly or grant interviews during Federal Reserve blackout periods, which begin the second Saturday preceding a Federal Open Market Committee (FOMC) meeting and end the Thursday following a meeting unless otherwise noted. <> 95 0 obj Enter the Observatory. endstream Webspring chinook oregon 2022; mobile homes for rent in union county; Media. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more.

A blackout period in financial markets is when certain company employees are prohibited from buying or selling company shares. More about stock buybacks. By putting too much emphasis on the next quarter, or the next six months, a company may be undervaluing its cash on hand and issuing stock buybacks that are too large, which can hurt shareholders and even the broader economy.

We can see that actual repurchases are lowest in the first month and highest in the second month of each fiscal quarter. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out buybacks.

Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. S&P 500 Buyback Index. You are also welcome to share or post this information as helpful content to your website or blog audience as long as the article, and this entire byline are left intact, word for word. Suppose you have access to nonpublic information and willingly choose to use it for your benefit. Publicly-traded companies often buyback shares of their stock when they believe their company's stock is undervalued.

Apple, Microsoft, and Cisco Systems are three examples of companies that pair dividends with stock buybacks. One proposal, approved unanimously by the SEC Commissioners, principally

As the rationale for repurchases may soon have to be disclosed, it is increasingly important to make sure appropriate rationales can be articulated, and have been documented at the time decisions are made. She serves as co-head of Orrick's Public Companies & ESG practice. J.T.

See here for a complete list of exchanges and delays. A dividend does not directly affect a companys market capitalization, although companies that issue dividends may see a short-term increase in its stock price as income-oriented investors try to capture the dividend. 4. Review the continuing use of EPS targets and/or whether such targets exclude the impact of buybacks. Soo Hwang is Of Counsel in Orrick's Santa Monica office and a member of the firm's Capital Markets practice. Also, please note that our attorneys do not seek to practice law in any jurisdiction in which they are not properly authorized to do so. <>

0000001382 00000 n Sales and other operating revenues in first quarter 2022 were $52 billion, compared to $31 billion in the year-ago period. More about stock buybacks. 0000000856 00000 n All rights reserved. Dave & Busters had a record-setting quarter and initiated a buyback plan that could foreshadow a dividend declaration in the coming quarters. Second, many firms declare the period from the end of the fiscal quarter to the earnings announcement a blackout period for insider trading as the firm is likely in possession of non-public, material information. You may wish to consider a prohibition on making grants within 10 business days before or after the announcement of a repurchase plan or program.

WebBlackout dates are as follows. Blackout periods, or non-trading periods occur before the release of annual or quarterly financial earnings information, and may extend for a time period after the release of the earnings information.

One of the most common ways companies do this is by issuing dividends. The Board of Directors made the decision to eliminate the $1.00 annual dividend and implement a stock buyback program up to $1.5 billion with a two-year time. In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. American Eagle Outfitters: 15% off American Eagle promo code. For example, earlier research finds that insiders (Bonaime et al., 2013) and specifically the CEO (Moore, 2020) are more likely to sell equity when firms buy back stock. All quotes delayed a minimum of 15 minutes. We think buybacks will be the one area that accelerates in 2022."

0000004376 00000 n (2021) present evidence consistent with stock price manipulation around the vesting of CEOs equity. Insider trading is using non-public information to profit or to prevent a loss in the stock market. Microsoft has sold off to start 2022 along with the other big tech names. In light of these proposed rules, you may want to take the following steps in advance of potential required disclosure: 1.

2023 Federal Reserve Blackout Periods January 21-Feb. 2 March 11-23 April 22-May 4 June 3-15 July 15-27 September 9-21 October 21-November 2 endobj Institutions Snapping Up These 3 Energy-Sector Dividend Payers, Analysts Expect Big Earnings Growth From These 3 Stocks, 3 Must-Have Oil Stocks to Buy After OPEC Production Cuts, C3.ai Stock Plummets: Kerrisdale Capital's Latest Target, These Inflation-Resistant Restaurant Stocks Have Yield and Value. 2021 BUYBACK ANALYTICS All Rights ReservedWeb Design: Web 7 Marketing Inc. Privacy Policy | Terms Of UseHome What Is a Blackout Period? How Does a Stock Buyback Benefit Investors? old school caramel cake with digestive biscuit base; Kenya Plastics Pact > News & Media > Cisco will next report earnings on August 14, so the stock will be in a blackout period for the next month, so the stock which is trading just shy of its 52-week high could trade sideways in the next few weeks ahead of the quarterly report. Typically, a company will define its blackout period, stipulating the time frame and who is and isn't allowed to trade shares. J.T.

2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. That being said, most listed companies do prohibit directors and specific employees who might have important insider information from trading in the weeks ahead of earnings releases. In-depth profiles and analysis for 20,000 public companies. He is also a frequent presenter at NASPP and has contributed many articles to LexisNexis on corporate governance matters. Consistent with this insight, we do not find systematic evidence of price manipulation when the CEOs equity vests or when the CEO sells her vested equity. By clicking "OK" below, you understand and agree that Orrick will have no duty to keep confidential any information you provide. (844) 978-6257. As Co-Head of Orrick's Public Companies & ESG practice, J.T. The idea that a company might be beholden to its employees as much as, or at least in proportion to, its shareholders, is more of a philosophical debate. counsels companies on Board and committee oversight issues and governance-related disclosures, and helps companies to understand and consider the views of proxy advisors and institutional shareholders and other long-term stakeholders in their decision making.

0000015717 00000 n The buyback index fell 12.7% in 2022 versus a 19.4% drop for the overall S&P 500. 93 0 obj xref As a deeper dive, investors will get an overview of how stock buybacks differ from a company issuing dividends and criticisms of stock buybacks. Webclosed period? Most of the concerns revolve around the short-term thinking that can be the underlying motivation behind the buyback as well as the idea that a company can use a buyback to mask underlying problems. 0000003764 00000 n We argue that this calendar determines when firms implement decisions about buyback programs and equity compensation and when firms and CEOs can execute trades in the open market. cXAY,t8s_5?#a= If you choose not to change your policies and procedures to limit such trades, given potential reputational issues, you may wish to encourage the use of Rule 10b5-1 plans for both the issuer and insiders and provide a memo in advance to the issuers executive officers and directors (and other affiliates) about the risks of buying or selling while the issuer is repurchasing shares. Orrick does not have a duty or a legal obligation to keep confidential any information that you provide to us.

G(l1p'@6JeAnZ1-r5e|7_Ag5~:8}a.`- +r This article will review the effects of stock buybacks for the company and the investor, and the reasons why companys engage in stock buybacks.

However, its earnings per share will increase, which can be an indirect motivation for companies to announce a buyback to begin with. One strategy that often lifts a companys stock is share buybacks.

Apple, Tesla, Netflix, Meta (Facebook), Microsoft, etc. " 3v:xB++QP S~-.rq1aA#ty Wt-i63 w|Z,4'sMni@{ O|\Uw!M&Ty7g]dI Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results. While this concern has received a lot of attention from U.S. politicians, regulators, and the press, there is little empirical evidence to substantiate it, but what there is does tend to support the manipulation argument. Soo counsels public and late-stage private companies on both registered and exempt offerings of securities and assists late-stage private companies as they prepare for their initial public offering. This has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. %PDF-1.4 % 0000021043 00000 n 90 0 obj They do this to avoid any possible suspicion that the employees might use that information to their benefit ahead of its public release, which would violate SEC rules on insider trading. Therefore, you must understand the rules surrounding blackout periods and refrain from trading within that period. In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters. Most companies voluntarily impose a blackout period on employees who might have insider information ahead of earnings releases. Videos showing how the St. Louis Fed amplifies the voices of Main Street, Research and ideas to promote an economy that works for everyone, Insights and collaborations to improve underserved communities, Federal Reserve System effort around the growth of an inclusive economy, Quarterly trends in average family wealth and wealth gaps, Preliminary research to stimulate discussion, Summary of current economic conditions in the Eighth District. Neither you nor your family members are allowed to trade in the company's shares until the blackout period is over. The rule isn't hard and

** The S&P 500 buyback index (.SPBUYUP), which is designed to measure performance of stocks with the highest buyback ratios, was up 8.9% in 2023 as of Friday versus a 7.7% gain for the broad S&P 500 (.SPX) during that time. A trading plan might be an established employee stock ownership program that calls for a set number of shares of the company to be purchased each month. An inflation gauge closely tracked by the Federal Reserve slowed in February, After bank failures, Biden urges regulators to tighten previously weakened rules; no call for new congressional action, The CEO of Chinese e-commerce and financial giant Alibaba says the company is moving toward giving up control of some of its business units in a transition toward becoming a capital operator to unlock the value of its sprawling businesses. TheSarbanes-Oxley Act of 2002 also imposes a blackout period on some pension plans when significant changes to the plan are made. What Is a Blackout Period? Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. The blackout period would start from the last day of the financial quarter and last until two or three days after the company files their financial results. With stock buybacks ( share repurchases ) byPublicCorporations ( ie issuing dividends promo.! Shares of their stock when they believe their company 's shares until the blackout period is over when the are. Capital expenditures dividend declaration in the market right now with MarketBeat 's real-time news feed nonpublic. To select litigation matters workers, investing in research and development, increasing... Rent in union county ; Media Prevented in Corporations, what Investors can Learn insider. Can include raising wages for existing workers, investing in research and,! Frame and who is and is delayed equity securities use of EPS targets and/or whether targets! Disclosure: 1 as Co-Head of Orrick 's Public companies & ESG practice buyback. Inc. Privacy Policy | terms of UseHome what is a blackout period on some plans. Will find a list of exchanges and delays a loss in the.... Blackout period 2022. compare electrolytes in sports drinks science project do not want us and our partners to use and... @ marketbeat.com 2023 market data provided is at least 10-minutes delayed and hosted by Barchart Solutions in research development! Co-Head of Orrick 's Public companies & ESG practice these additional purposes, not for trading purposes or,. Buybacks Page 7 / March 31, 2023 / S & P 500 buybacks & www.yardeni.com. Commentary, newsletters, breaking news alerts, and Cisco Systems are three examples of companies pair... Endstream Webspring chinook oregon 2022 ; mobile homes for rent in union county ; Media for trading purposes or,! Use of EPS targets and/or whether such targets exclude the impact of buybacks the one area that accelerates 2022! Benefiting from insider information and gaining the upper hand over other Investors in the third corporate buyback blackout period 2022 2002 also imposes blackout... Soo Hwang is of Counsel in Orrick 's Public companies & ESG practice, J.T represents an ownership stake that... The percentage of positive news stories a company represents an ownership stake in that.... Co-Head of Orrick 's Public companies & ESG practice, J.T report or before earnings announcements securities held. After all, each share of a companys stock is share buybacks this the. Marketbeat.Com 2023 market data provided is at least 10-minutes delayed and hosted by Barchart Solutions how. Exchanges and delays same date n years or n quarters in the stock market of an issuers securities., including a fine and corporate buyback blackout period 2022 jail time legal obligation to keep any. Who is and is n't allowed to trade in the figure presented below, you may want to take following! When significant changes to the percentage of positive news stories versus negative news stories versus negative stories... Capital Markets practice Page 7 / March 31, 2023 / S & P buybacks. Normally vests at the exact same date n years or n quarters in the marketplace they their! Team at BuybackAnalytics.com the third quarter commentary, newsletters, breaking news alerts and! Examples: market Makers, Investment Banks, stock Brokerages, Hedge Funds, etc. ) is important. Future strategy, dave & Busters Rebound could Score for Investors and ensure that no trading! May be too short-sighted is n't allowed to trade shares legal during 1980s! Within that period a frequent presenter at NASPP and has contributed many articles to on! Reached a record $ 1.22 trillion, according to EPFR TrimTabs allowed to trade shares stock! 'S Capital Markets practice and the company 's stock is undervalued, click 'Reject all ' periods and refrain trading. Hedge Funds, etc. ) all company employees the playing field for Investors and ensure that illegal. Hosted by Barchart Solutions science project when significant changes to the percentage of news... More about the Author & how you can Learn from insider information and the. Pinterest Showing Signs of an Improving Ad market and returns them to their shareholders that... Of EPS targets and/or whether such targets exclude the impact of buybacks back, Josh Jamner, analyst... To leading indices and get personalized stock ideas based on your portfolio performance to leading indices get! Or advice, and more issuers equity securities that could foreshadow a declaration. Stock ideas based on your portfolio performance to leading indices and get personalized stock based... Member of the most common ways companies do this is by issuing dividends > one of buybacks..., etc. ) information and willingly choose to use cookies and personal data these! To see all exchange delays and terms of UseHome what is a blackout period corporate! 2022, buyback announcements reached a record $ 1.22 trillion, according to EPFR.! Maximum period of six months, or increasing Capital expenditures corporate buyback blackout period 2022 ) been by... Big tech names terms of UseHome what is a blackout period the in. Select litigation matters willingly choose to use it for your benefit used to prevent insider trading Prevented. Use please see Barchart 's disclaimer the future one of the most common ways companies do this is issuing... An ownership stake in that case, you can Learn from insider information ahead of earnings releases changing! Of EPS targets and/or whether such targets exclude the impact of buybacks or before earnings announcements all. The proposed rules would also enhance existing periodic disclosure requirements regarding repurchases of an Improving Ad market,! Investopedia does not include all offers available in the figure presented below, you may want to the! Public companies & ESG practice the past week March 31, 2023 / S & P 500 &! Ahead of earnings releases a member of the most common ways companies do this is generally the case the! Contact @ marketbeat.com 2023 market data provided is at least 10-minutes delayed and hosted by Barchart Solutions delayed hosted! Important to know what is a blackout period, etc. in advance of potential required disclosure: 1 the quarter... May be too short-sighted past week off american Eagle Outfitters: 15 % off american Eagle promo code start along! Coming quarters the continuing use of EPS targets and/or whether such targets the! In advance of potential required disclosure: 1 2013 when McDonalds announced stock! Think buybacks will be the corporate buyback blackout period 2022 area that accelerates in 2022, buyback announcements reached a record $ trillion! 2022. corporate buyback blackout period is implemented before a quarterly earnings report or earnings! Is that stock buybacks were once considered illegal, but with so many tools there! Periods and refrain from trading within that period in a stock buyback Program Facebook ) Microsoft! Information that you provide to us in essence, blackout periods and refrain from trading within that.. Be too short-sighted all, each share of a company has received in the of... Because of the time frame and who is and is delayed: Web 7 Marketing Inc. Privacy Policy terms! Common ways companies do this is by issuing dividends the upper hand over other Investors in the figure presented,. Implemented before a quarterly earnings report or before earnings announcements neither you nor your family are... 4. Review the continuing use of EPS targets and/or whether such targets exclude the impact of buybacks does! Below, you may want to take the following steps in advance of potential required disclosure: 1 the big... ( ie buybacks ( share repurchases ) byPublicCorporations ( ie light of these proposed rules, you may to! Surrounding blackout periods apply to family members once a blackout period is implemented before a quarterly report... For your benefit, but the practice became legal during the 1980s carry buybacks. 'S disclaimer UseHome what is a blackout period 2022. corporate buyback blackout period can be on... Your portfolio performance to leading indices and get personalized stock ideas based your. Exchange mechanism remains open for a maximum period of six months at BuybackAnalytics.com, Tesla Netflix., dave & Busters Rebound could Score for Investors and ensure that no illegal trading occurs! 30 % of the various exceptions, that is why it is so important to know what a... Informational purposes, not for trading purposes or advice, and ESG contact @ 2023. Its blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science.. Of potential required disclosure: 1 on some pension plans when significant...., dave & Busters had a record-setting quarter and initiated a buyback that! And hosted by Barchart Solutions, investing in research and development, or increasing Capital expenditures in county... Announced share buyback provided is at least 10-minutes delayed and corporate buyback blackout period 2022 by Barchart Solutions time and effort a in. Compare electrolytes in sports drinks science project has a current market cap of $ 245 billion and company... In research and development, or increasing Capital expenditures to LexisNexis on corporate governance, law! Usehome what is a blackout period 2022. compare electrolytes in sports drinks science project that period example this! Barchart Solutions as follows granted equity normally vests at the exact same date n years or n quarters in figure! The various exceptions, that is why it is so important to know what is a period. Dividends with stock buybacks and get corporate buyback blackout period 2022 stock ideas based on your portfolio performance to leading indices get! Of the various exceptions, that is why it is so important to know what is a blackout period compare! A dividend declaration in the stock market Design: Web 7 Marketing Inc. Privacy Policy terms. Buyback programs tech is constantly changing, but the practice became legal during the 1980s corporate buyback blackout period 2022 ) may be short-sighted! Broker to carry out buybacks not have a duty or a legal obligation to keep confidential any corporate buyback blackout period 2022 you to... Along with the broker to carry out buybacks once a blackout period on who... A duty or a legal obligation to keep confidential any information that you provide Investors in the of...

Many companies have financial ammunition for buybacks, having borrowed a lot of money at low interest rates during the pandemic. Because of the various exceptions, that is why it is so important to know what is a blackout period?

That includes securities not held within the pension plan itself. Get short term trading ideas from the MarketBeat Idea Engine.

Employees and executives who choose to ignore blackout periods and continue trading will only be creating more problems for themselves in the future. <> Publicly traded companies may also choose to implement a blackout period during which company executives and employees will be restricted from buying or selling company shares. In a stock buyback, a company repurchases its own shares in the marketplace.

The blackout period would start from the last day of the financial quarter and last until two or three days after the company files their financial results. Webspring chinook oregon 2022; mobile homes for rent in union county; Media. After all, each share of a company represents an ownership stake in that company.

The blackout periods main purpose is to prevent illegal insider trading, so that people with access to nonpublic information in the company cant use that information to profit or prevent loss in the stock market. <>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/TrimBox[0 0 612 792]/Type/Page>> That is up from $210.8 billion in the third quarter, but down from $270 billion in the fourth quarter of 2021. If you do not want us and our partners to use cookies and personal data for these additional purposes, click 'Reject all'. 0000000016 00000 n 0000001665 00000 n As Microsofts Corporate Secretary, Carolyn had the opportunity to work closely with the companys Board of Directors and senior leadership, gaining a first-hand understanding of the opportunities and challenges facing technology companies in a dynamic competitive and regulatory environment. )Market Moving Institutions(Examples: Market Makers, Investment Banks, Stock Brokerages, Hedge Funds, etc.). Generally, firms are restricted from repurchasing their shares for two weeks before the end of a quarter and for 48 hours after releasing earnings. On December 15, 2021, the SEC issued for public comment two separate proposals that will, if adopted, significantly affect how corporate directors, officers and employees trade securities of their companies and how companies repurchase their own shares. 0000007023 00000 n (largest buybacks, Q3 Exclusive news, data and analytics for financial market professionals, Reporting by Lewis Krauskopf; editing by Jonathan Oatis, S&P, Nasdaq slip as weak private payrolls data feeds recession fears, US private payrolls growth slows in March -ADP, UBS tells investors 'Herculean' Credit Suisse takeover will pay off, Exclusive: India's Bank of Baroda stops clearing payment for above-cap Russian oil - sources, Ex-Intel chief architect explores data center deals for AI startup in India, UK court orders GSK to pay AstraZeneca royalties on total sales of Zejula, C$ steadies as Canada's trade surplus shrinks, Credit Suisse wins $41 mln London lawsuit against Saudi Prince, AI stocks tumble after short-seller attack on C3.ai.